Tax & Compliance

Optimize tax and compliance management with faster processing and a single source of truth.

„*“ zeigt erforderliche Felder an

Capabilities

Elevate Your Tax & Compliance Function to a Strategic Level

Accelerate Reporting and Empower Informed Decision-Making with a Unified Solution.

Use Cases

Empower Efficient Tax and Disclosure

Management Processes

Do you find yourself caught in a cycle of spending excessive time on low-value tasks, solely to ensure the accuracy of your data? Are you exhausted from dealing with manual, time-consuming processes and outdated information? If so, it's time to seek a solution that can offer streamlined functionality and alleviate these challenges. You need a flexible and user-friendly solution that centralizes all your data, eliminating concerns regarding accuracy and governance.

Imagine a solution that simplifies your workflow and empowers you to focus on high-value initiatives. One that provides a unified platform where you can effortlessly manage and access all your data, enabling you to make informed decisions quickly and confidently. Say goodbye to the burden of manual data manipulation and outdated processes. With the right solution in place, you can cut your report creation time in half, freeing up valuable resources to concentrate on strategic tasks that drive growth and innovation. Embrace a future where your data works for you, enabling you to unleash your organization's true potential.

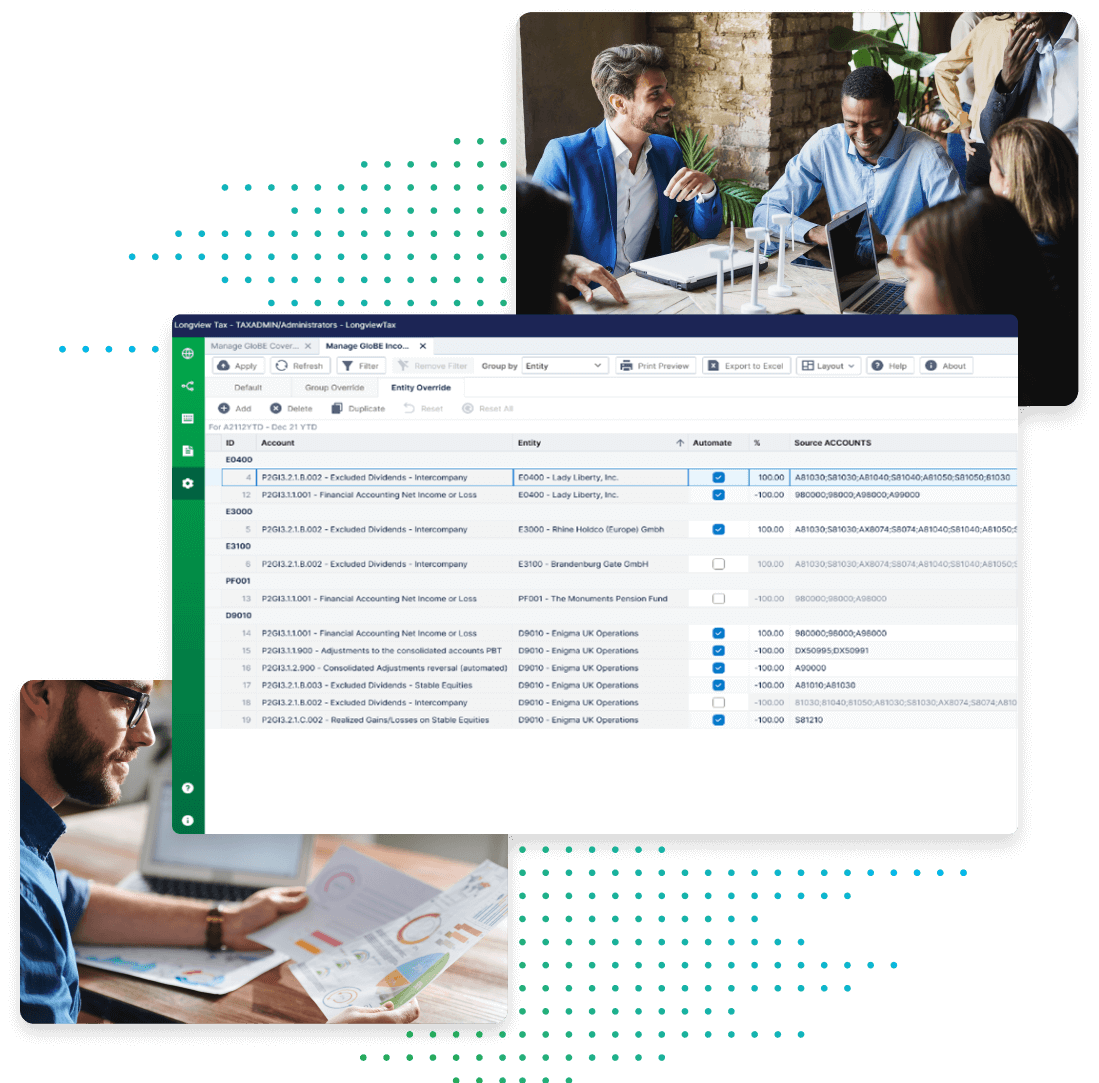

Professionals across various industries often encounter challenges when attempting to analyze and compare data across different jurisdictions and business units. However, by implementing a centralized and standardized data approach, they can unlock deeper insights and drive informed decision-making. A crucial benefit of utilizing a single source of truth for tax data is the ability to perform comprehensive analysis with accuracy and consistency. By harmonizing data across various entities and locations, professionals gain the ability to compare „apples to apples,“ eliminating discrepancies.

To achieve this, you need a solution that functions as a single source of truth to standardize your processes and promote strategic analysis. You need a solution to make sure you tell the most accurate, up to date story around your company’s numbers.

Seamless integration plays a pivotal role in ensuring consistent and efficient reporting processes. By leveraging direct connectivity to source data and incorporating links to data items across documents, organizations can establish a single version of truth, reduce manual errors, and streamline their reporting workflows.

To ensure you have the most up to date, accurate information, you need a solution that enables your company to access the most up-to-date information directly from their data sources, ensuring accuracy and consistency in reporting. By eliminating the risk of working with outdated or disconnected data, organizations can confidently present a unified and accurate view of their financial information.

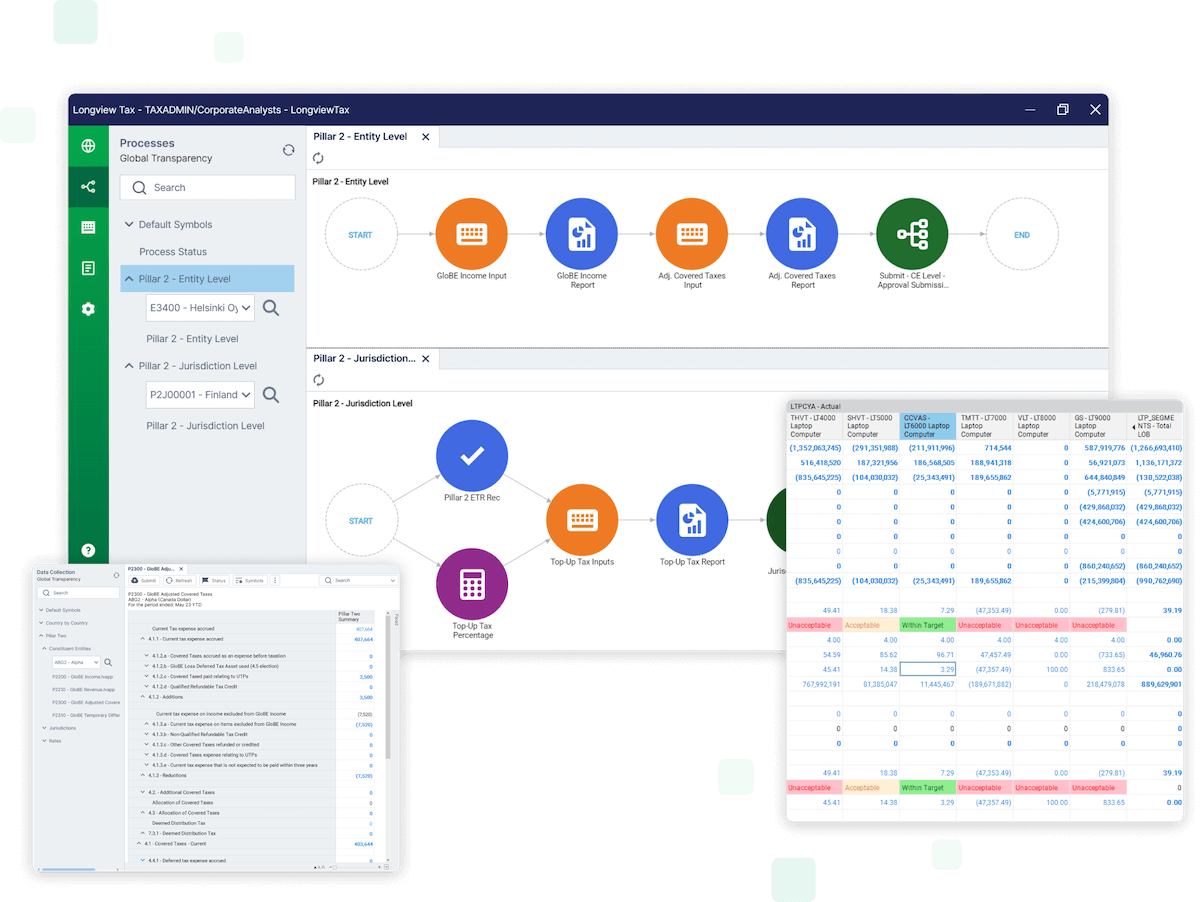

BEPS regulations pose a significant challenge for your tax calculations. You need to handle more data and more complexity than ever before. How can you ensure your tax team works efficiently and effectively in this changing environment? How can you prepare for the new requirements of Pillar 2? You need a flexible system that supports your data and analytics needs while enabling your team to collaborate.

Hours are lost chasing after spreadsheets and pouring over manual calculations. By automating these processes you’ll be able to devote more time and energy to more strategic activities.

Data silos and static Excel models hinder your team’s ability to move at the speed of your business. Creating a centralized framework for standard calculations helps to dismantle data silos and reduces time spent on manual processes while ensuring the integrity and transparency of your department’s work.

Capturing accurate data required for Country by Country (CbC) reporting can be a frustrating and tedious process, requiring you to manually stitch together data from disparate systems to prepare data for Tables 1,2, and 3 of the report.

Choosing the right ESEF reporting software for complying with the European Single Electronic Format (ESEF) requirements could be the kickstart you need on your journey to greater finance efficiency and effectiveness.

With the right software, compliance becomes an opportunity to streamline and integrate all the data-gathering and presentation aspects of financial reporting, leaving your finance team better placed to deliver strategic value.

Newly issued regulatory recommendations or mandates often lack specificity, and are subject to multiple iterations, causing companies to have to adapt each time an update is made.

Gathering the data needed for ESG reporting will likely require establishing new reporting integrations or collaborating with a new team of internal stakeholders. Manually compiling data is error prone, posing a risk of non-compliance. This can have an impact on your firm’s ability to attract investment.

Create an environment to manage the ESG reporting process quickly and securely. Drive definition in the reporting process to help define data flow and identify which stakeholders will be engaged in each part of the report authoring and approval process. Provide a layer of security that allows access and editing capabilities to the appropriate parties.

10-Q and 10-K filings are time-consuming, complex processes that require your finance team to gather and translate large amounts of data from multiple sources. The time and expertise required to complete the process is a substantial burden on your team.

There’s no need to choose between speed, accuracy, and security when you utilize a fully integrated SEC reporting solution. From audit trails by section, to automated notifications and robust access controls, robust disclosure management software provides security, automation, and disclosure integrity.

When your systems and your people don’t talk to each other during the reporting process, a lot of valuable information and knowledge can get lost.

Silos, inefficiencies, and mistakes arise without the ability to track comments in a report and communicate with other team members. Software that includes features like in-app commentary and storyboard functionality helps to eliminate much of the struggle related to collaborative reports and telling the story behind your numbers.

Produkte

Ensure Accuracy and Eliminate Error Prone Processes

Roles & Industries

Utilizing Tax and Compliance Software

Tax and Compliance software is used by a variety of roles within organizations across the tax and finance functions as well as the regulatory functions.

VP of Tax

A VP of Tax manages global tax compliance and reporting obligations for various business entities. They often oversee the completion of Federal and/local state income tax returns including all related analysis and support. Tax software can help a VP of Tax:

- Close faster while reducing dependency on other departments

- Eliminate costly consequences of error prone manual tax management

- Establish a single source of truth that promotes strategic analysis

Group Financial Controller

A group financial controller reports to the CFO and controls the flow from consolidation through to report. They often manage the group’s financial and treasury systems and practices, ensuring financial information is timely, accurate, complete and compliant with relevant accounting and taxation principles. They care about accuracy as well as visibility.

Disclosure management software can help them:

- Accelerate their reporting process

- Ensure the most accurate and up to date information, even with late changes

- Ensure every report is always in perfect alignment through direct connectivity

FAQs

Tax and disclosure management software brings efficiency, accuracy, compliance, and better decision-making to an organization’s tax processes, ultimately saving time and reducing costs while ensuring regulatory compliance.

You can ensure the security of your financial data in the cloud by choosing a reputable vendor that follows industry best practices and standards for data encryption, backup, recovery, authentication, authorization, and monitoring.

Ensure the vendor you choose to work with offers seamless integration that can easily connect to your primary data sources, such as ERP systems, spreadsheets, databases, or cloud applications, and that they are able to extract, transform and load this data into their software platform.